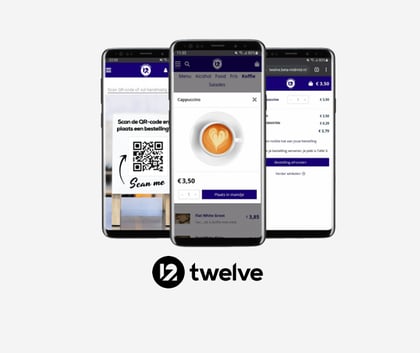

Platforms & alliances

The benefits of a Pay. alliance.

- Uniform omnichannel payment platform

- Easy integration and extensive documentation

- Complete insights into flows and transactions with API or the partner portal

- Onboard new merchants easily on the Pay. platform, the API or with a partner code

- Settle charges with the book balance of merchants

- Get personal support from your dedicated Pay. Partner Manager